Investor Concerns Prompt Decline in SuperX AI Technology Stock

December 19, 2025 - 22:25

Investors tend to get skittish when a company feels compelled to raise capital, and this week, SuperX AI Technology found itself in the spotlight for just that reason. The tech firm announced plans to secure additional funding, which sent ripples of concern through the investment community.

As news broke, shares of SuperX AI Technology experienced a notable decline, reflecting investor apprehension regarding the company’s financial health and future prospects. Analysts suggest that the decision to raise capital often indicates underlying challenges, prompting investors to question the firm’s stability and growth trajectory.

Market experts point out that such moves can lead to dilution of shares, further exacerbating investor fears. The company's leadership has stated that the funds will be used to accelerate innovation and expand operations, but skepticism remains high. As SuperX navigates this turbulent period, stakeholders are closely monitoring how the situation unfolds and what it means for the company's long-term viability.

MORE NEWS

February 14, 2026 - 07:40

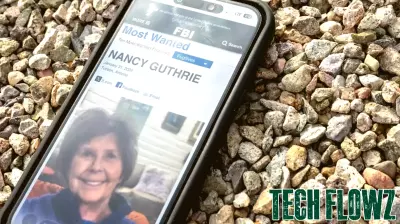

Hope and technology can push Nancy Guthrie investigation forward as case nears 2-week markAs the investigation into the disappearance of Nancy Guthrie approaches the two-week mark, authorities are emphasizing that the passage of time does not diminish hope. Instead, modern investigative...

February 13, 2026 - 11:22

Ricoh acquires leading process automation and document management technology company ValueTech in Chile | GlobalRicoh has significantly bolstered its digital services portfolio in Latin America with the acquisition of ValueTech, a prominent Chilean technology company. The deal, finalized by Ricoh Chile S.A.,...

February 12, 2026 - 00:53

How technology amplified Black music's cultural exchange : World Cafe Words and Music PodcastThe digital revolution has fundamentally transformed how Black music travels, evolves, and sparks global dialogues. Where once the exchange of sounds was limited by geography and distribution,...

February 11, 2026 - 03:29

Drone technology has come a long wayAgricultural experts are highlighting the rapid evolution of drone technology, which has become an indispensable tool for modern farming in less than a decade. According to a prominent agronomist...